Coral Gables Sales - September 2009

I know last week’s post about the Palmetto Bay market was quite a surprise to many, so I wanted to follow up with a similar comparison in the Coral Gables market. The bulk of sales in Palmetto Bay over this past year ranged between $300,000 and $500,000, so I used a price range between $200,000 and $600,000 in Coral Gables. The biggest difference between these two markets is that at the height of the market Coral Gables was close to being out of this price range altogether. Thus, Coral Gables’ numbers of comeback are not as dramatic as Palmetto Bay’s, but they are encouraging nonetheless.

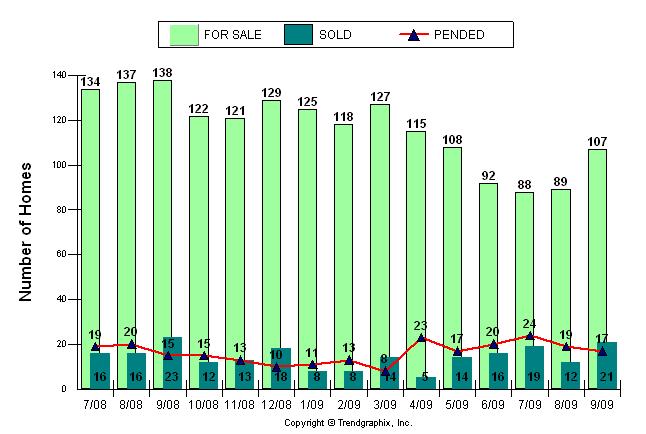

The graph shows that in September of 2008 there were 136 listings between $200,000-$600,000. This September there are 107. That is an inventory decrease of 21% over a one year period. Though actual sales are down 9.1%, the pended properties are up 13.3%. Last September properties had already pended and were still closing before we saw our significant decline, making these numbers even more encouraging.

Remember my discussion last week that a balanced market is defined by real estate professionals as a 6 month inventory? Well, last September there was a 9 month inventory and Coral Gables is now just above a 6 month inventory. Obviously, Coral Gables ranges far higher in prices overall, so these prices discussed today are a small view of what is going on in the Gables. That being said, it is a positive glimpse and goes to show that the lower price ranges are seeing great activity.

This is a reflection of many first time home buyers entering the market. This group of buyers has nothing to sell and everything to gain, by getting in now. The $8000 tax credit for first time home buyers has been an additional incentive and they are currently working on extending this to April 30th of 2010.